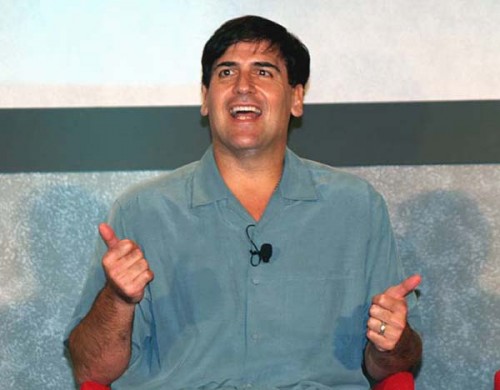

Dallas Mavericks owner and media tycoon has just been charged with insider trading according to a Yahoo/CNN Money Report.

The report stems from activity that took place in June of 2004, when Cuban instructed his broker to sell 600,000 shares of "Mamma.com" just one day before it took a 9.3% dive in value, saving Cuban approximately $750,000.00.

"As we allege in the complaint, Mamma.com entrusted Mr. Cuban with nonpublic information after he promised to keep the information confidential...Less than four hours later, Mr. Cuban betrayed that trust by placing an order to sell all of his shares."Cuban has yet to be reached for comment.

-Scott W. Friestad, Deputy Director of the SEC's Division of Enforcement. (Source:CNN Money)

The Wall Street Journal explains that Cuban was entrusted with the information that Mamma.com was "raising money through a private investment in a public entity, or PIPE." The following day, (after Cuban sold his shares) Mamma.com announced their move, resulting in the share price decline. PIPE transactions typically result in shares being sold at a reduced price (compared to the trading price) and result in a lowered trading price (as the information hits the market) as shares become diluted (more shares in the market) and the pricing of some shares is reduced (suggesting their actual value is lower).

Since Cuban's frustrated post in which he thanks the fans for hanging in their, we've yet to see any type of response, though we doubt there would be any...on his blog...before he gets arrested and receives the Martha Stewart treatment.

UPDATE 12:48 PM: Check out the text of the complaint from the SEC. Of note is that Cuban will be required to pay back the $750,000 he "gained" by selling his shares (by gained, we mean avoided losing), a prejudged amount of interest on said gain and a civil penalty (in accordance to the rule, not to exceed roughly $2.25 million)

The SEC obtained fairly specific e-mail and phone records. Of note: an e-mail entitled "Call me pls" from the CEO of Mamma.com which Cuban responded to roughly 4 minutes later, where he had an 8 minute and 35 second phone call. During said phonecall, Cuban was told by the CEO of the PIPE offering to which Cuban became purturbed and ended the call exclaiming: "Well, now I’m screwed. I can’t sell."

After investigating the PIPE withthe investment bank, Cuban called is broker and stated "sell what you can tonight and just get me out the next day.”

His broker managed to sell 10,000 shares that night (in afterhours trading) at roughly $13.50 per share. The following day his broker sold the remaining 590,000 at roughly $13.30 per share. That evening, Mamma.com announced the PIPE offering (at 6pm, after the market close). Mamma.com opened the following morning at $11.89, down 9.3%. The SEC also maintains that Cuban publically stated that he sold his shares as a direct result of the PIPE offering to Mamma.com

UPDATE II: Cuban has Responded on his blog

No comments:

Post a Comment